Triple Your Earning Power by Becoming an Enrolled Agent (EA)

New, Fully Updated EA Exam Preparation Program Helps You Pass The EA Exam on the First Try — Pronto!

-

Learn which areas of tax law have the most and least questions on the Exam

-

Use our diagnostic testing system and adaptive drills to shore up the weak areas of your tax knowledge

-

Take simulated exams to hone your test-taking skills — our simulated exams look and feel exactly like the real Exam

-

View real-life examples of tax law in action, to move beyond mere memorization into actual understanding

-

Track your progress and only go take the Exam when you know you're ready!

Why to Become an Enrolled Agent (EA)

How Exactly Is This Credential Going To Benefit You?

How the Program Works

STEP 1

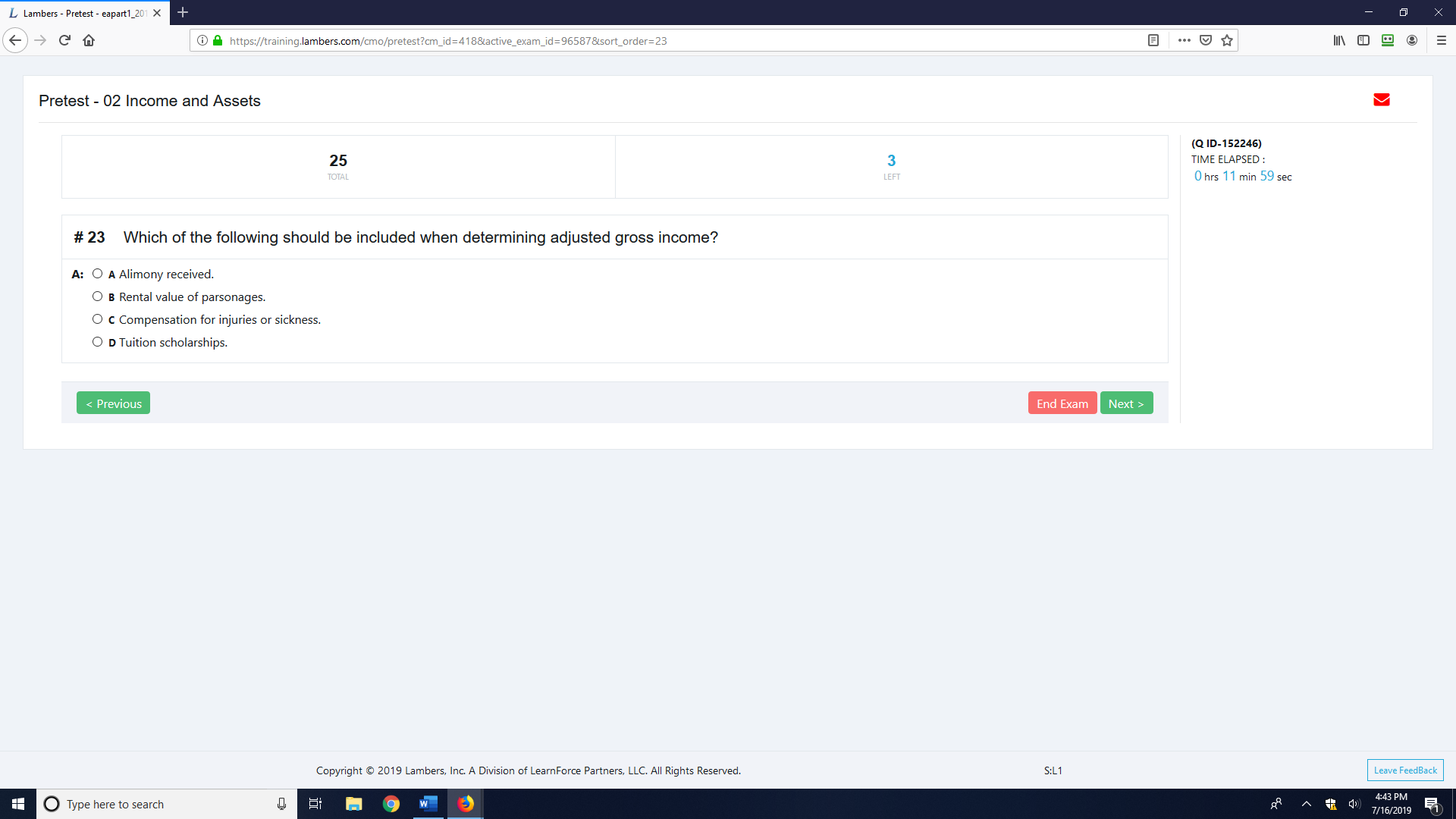

The Diagnostic Pre-Test

As tax professionals, we all have stronger and weaker areas of our knowledge; some topics we deal with all the time, and understand very well, others we rarely see and barely know. The first step to passing the EA Exam is to know where you need to focus your study. Our diagnostic pre-test system establishes a "baseline" for your study, showing you exactly which areas you'll need to focus on in order to pass the Exam. The diagnostic pre-test also acts as the starting point for our historical analysis feature, which shows how much you've improved since you started using our system!

STEP 2

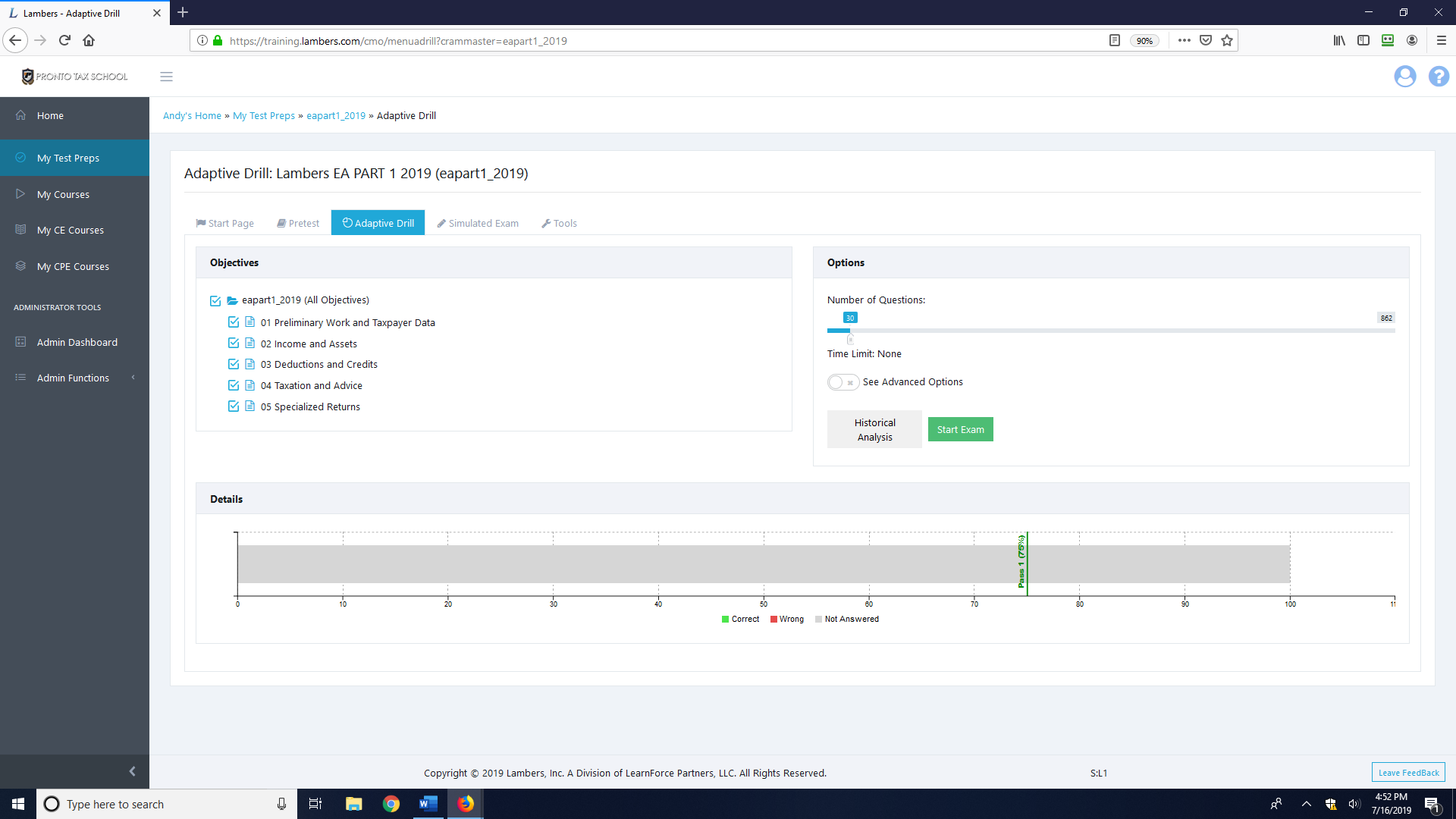

Adaptive Drills

Now that you know where you are now with our diagnostic pre-test, it's time to really dig into the core of our Program: the Adaptive Drills section. Our Adaptive Drills--a series of questions which mimic the real EA Exam--test you on every single topic area on the Exam, once again allowing you to focus your study time on shoring up weaker areas of your tax knowledge. Explanations are provided for every single question in the Adaptive Drills, including links to the IRS publication that pertain to that question! Using our Adaptive Drills will cement your existing, strong knowledge areas and shore up weaker areas of your knowledge. Using Adaptive Drills is the proven way to pass the EA Exam!

STEP 3

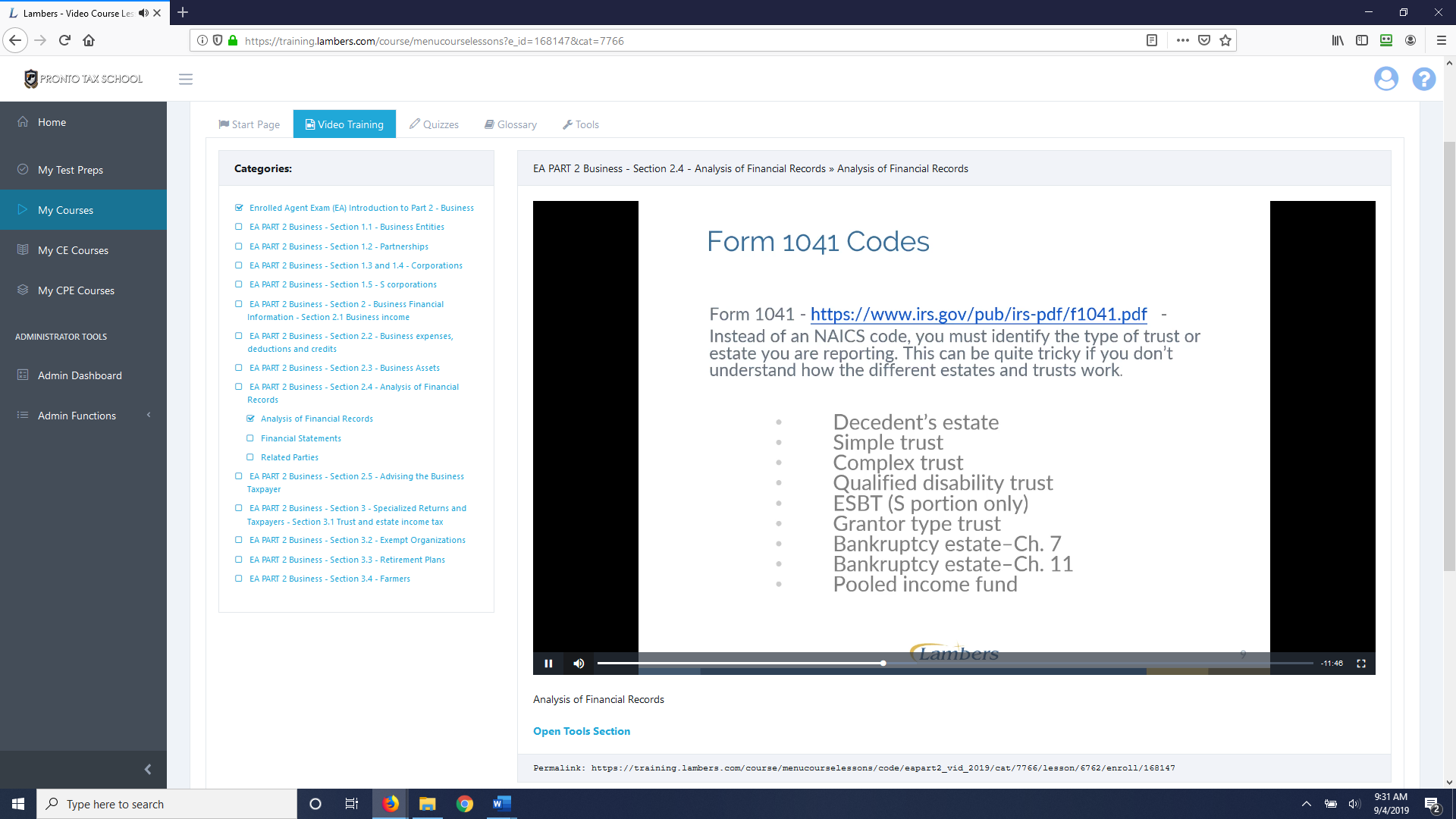

Video Explanations, for Everything (Optional)

Included with our "Total Package" option (described below), you can access detailed video explanations for every single topic on the Exam. We literally go through every topic, in detail, on video. Use the Adaptive Drills to identify those areas where you need further instruction, then use the Video Explanations to obtain that further instruction. Then "rinse and repeat" that process--Adaptive Drills to see where you need explanations, then Video Explanations of those topics--for as many topic areas as you need! Many tax professionals will be able to pass the Exam just using our "Fast Pass" option (described below), but for those who really want to know that you'll pass on the first try, the Video Explanations are a game-changer!

STEP 4

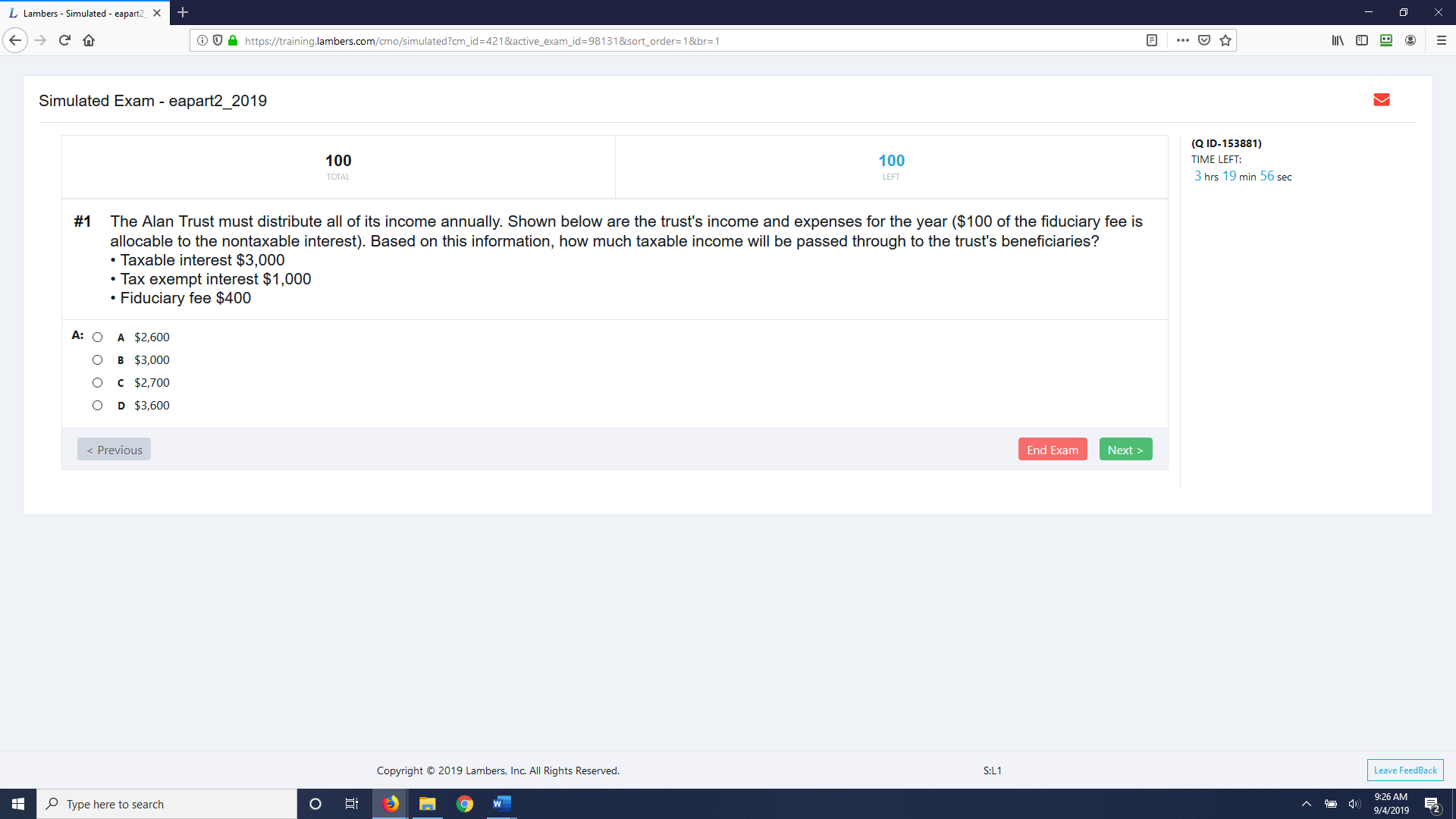

Simulated Exams

Once you've been using the Adaptive Drills and the explanations of each question to test yourself on every part of the Exam topics, it's time to start working with our Simulated Exams. These practice tests look and feel exactly like the real EA Exam, with the "countdown clock" and everything. Especially if you are someone who has a bit of a phobia about taking tests, it helps tremendously to take these Simulated Exams. If you're not scoring at a passing rate yet, simply go back through the Adaptive Drills and topic explanations, and then come back and take the Simulated Exams again. Once you're consistently passing the Simulated Exams, you'll know--not think, know--you're ready to go pass the Exam with confidence!

What Are Other People Saying About this

EA Exam Preparation Program?

Thanks for the awesome EA course Pronto! It wasn't easy. But, I'm SO glad it's done. :) Now I can get back to work!

I felt that the Pronto course was perfect for my learning style. I liked the video training and the way the material was presented. All exams were passed on the first attempt, which I and my checkbook are ecstatic about.

Becoming an Enrolled Agent is the quickest way for tax professionals to take advantage of the hottest area in tax today: Tax Resolution.

As an EA, I can offer additional services, primarily tax resolution. I am generating more revenue than I was prior to obtaining my EA license, and I feel confident in working with more complex tax returns.

EA Exam Prep Members Receive:

Training

We teach you about every single topic that's on the test.

Tools

We test you on every single topic that's on the test.

Support

We support you every step of the way, in every way we can.

Find the Plan That's Right For You:

All plans come with a 14-Day Money Back Guarantee, allowing you to review the product in-depth and make sure you're 100% satisfied!

Total Package

$747

-

This package includes:

-

- Lifetime access! No expiration date, you can access this course for as long as you want!

- Diagnostic Pre-Test, to show you where you are now before you begin your journey

-

- Adaptive Drills, showing you where you're strong and weaknesses that you need to shore up before taking Exams

-

- Comprehensive video explanations of every part of the Exam topics

-

- Simulated Exams, when you go to take the real exams, you'll feel like you've been here before

-

- Detailed "EA Study Tips & Tricks" video from instructor

-

- Ask questions directly to instructor, at no additional cost

-

- "Fast Study Flash Cards" testing you on all the terms you need to know to pass (great for mobile phone studying on the go)

-

- Pronto Tax School's Founder and CEO, Andy Frye's "Roadmap to Tripling Your Income as an EA" (Andy walks you step-by-step through his proven process)

-

- Andy Frye's "plug and play" email sequence that explains to your existing clients how you becoming an EA benefits them (including a notification of upcoming price increase for your services, if you choose to raise)

-

- Andy Frye's "plug and play" emails for reaching out to non-EA tax professionals whose clients will need help from an EA sometime soon (partnership opportunity)

-

- Andy Frye's "plug and play" presentation materials for "How to Choose a Tax Professional" (breaks down the CPA vs. EA issue and much more)

-

- Andy Frye's "How to Sell Tax Problem Resolution Services" Training Video

-

- Andy Frye's "How to Sell Tax Consulting Services" Training Video

Want to Customize a Package?

Just need one or two parts? Want to talk over your options and make sure you get the right solution for you? Our expert consultants can help you put together the perfect package for you!

It's so easy to make this math work.

Are you price-sensitive and want to make 100% sure you're getting the best deal? We're that same way, too! We want you to compare our EA Exam Prep Course to every other product on the market and choose ours.

That being said, let's make sure we are on the same page:

Tax professionals who are successful in passing the EA exam--and then, more importantly, become highly successful EAs, such as tripling your earning power--treat our EA Exam Preparation Course as an investment.

The way to get the "best deal" is to pass the Exam and then use your EA to earn more money!

Be careful then about basing your decision on getting the cheapest price because that can be very expensive.

Due to IRS increases in testing fees, it now costs over $540 to "sit" for the Exam (total, between all three parts).

What's more expensive in the long run, investing in an excellent EA test prep course that helps you pass the first time, or "cheaping out" and "hoping" you'll pass the exam and then you don't pass?

Do you really want to risk having to sit for (and PAY for) the test multiple times?

What about the psychological loss of confidence and flat-out misery that happens when you fail a test? How expensive is that? Does it failing a test the first time make it easier or drastically more difficult to pass that test the next time you try?

You can trust us on this, because we've seen it all too many times:

Tax professionals who cheap out and try to just read from IRS publications, get some fly-by-night EA prep course, or take other "shortcuts" frequently fail the exam.

Meanwhile, tax professionals who utilize advanced diagnostic testing systems, high-quality explanations of complex topics, and work with trusted team members pass the Exam with much more confidence and much more certainty.

Why go into the exam "wondering" if you'll pass?

The IRS tells us exactly what's on the exam, our diagnostic testing systems tell you exactly what areas you need to study, our comprehensive PDF and video training explains in detail every single aspect of the exam topics, and our system tells you exactly when you're ready to go in and pass the exam with confidence.

If you'd rather "give it a try" and "hope for the best," we sincerely wish you luck. If you can make it work, we aren't here to say you're wrong or tell you how to live your life. We're just letting you know that we've seen many, many tax professionals try to take shortcuts and that approach generally turns into a long cut or a dead end.

If you're serious about becoming an EA and tripling your earning power and you DON'T WANT TO TAKE ANY CHANCES and you JUST WANT TO GET IT DONE, our humble, yet informed recommendation is that you make the affordable investment in a high-quality EA prep course that helps you pass the exam the first time, with confidence -- PRONTO!

FAQ

Here are answers to some frequently asked questions:

What are the benefits of becoming an Enrolled Agent (EA)?

There are two main benefits of obtaining the EA credential: 1) you'll prove your advanced tax knowledge to your clients and the general public and, by doing so, you'll attract higher-paying work, and 2) you'll be able to represent clients with IRS issues, allowing you to access the booming area of the tax industry known as Tax Problem Resolution.

Why do you say "triple your earning power"? Is that realistic? Is this a scam?

Let's be clear. We are not saying that becoming an EA will triple your earnings. We are saying that becoming an EA will triple your earning power. It's not having the EA credential that earns you more money. It's what you do with it. That's why our Total Package includes specific, actionable resources for putting your EA to work from day one! Meanwhile, the salary research website PayScale.com puts the average salary of an EA at $48,229. And they put the average pay of a non-EA tax preparer at $12.59 per hour. You can make good money as a tax professional without being an EA, we know many tax pros who do. However, based on our experience in serving over 15,000 tax professionals, in general we see EAs earning substantially more than non-EA tax preparers.

How exactly does becoming an EA increase my earning power?

1) Do more complex work with confidence. For instance, working with LLC and S corporation clients.

2) Do Tax Problem Resolution work.

3) Do Tax Consulting work.

All three of these areas are seeing explosive growth and EAs are perfectly-positioned to capitalize.

Why is the demand for Tax Problem Resolution growing so rapidly?

Over 19 million taxpayers owe the IRS money and haven't paid. The main reason the demand for Expert Tax Problem Solvers is growing is because so many more taxpayers are self-employed these days; experts predict that up to 50% of all American workers will be self-employed by 2020. This will undoubtedly lead to more tax problem resolution work and will increase the demand for EAs who are licensed to do this kind of work.

What is "Tax Problem Resolution" work?

Tax problem resolution work entails solving tax problems for taxpayers. This can includes setting up installment agreements, settling tax debts for less than is owed through the IRS Offer in Compromise program, reducing or eliminating penalties assessed to taxpayers, and all kinds of other fun stuff. This is an incredible way to help clients.

Can I complete this course at my own pace? How long do I have access to the course?

Yes, this is an online course, you can work through it on your own schedule. You have 365 days from the date you first access the course included with your purchase.

Do you provide support for this product, if I have additional questions?

Yes, through our teammate Lambers, we provide you with full tech support for the product itself, as well as "Ask the Expert" support if you have questions about the materials themselves or the process of becoming an EA. Support is available via email and phone. Phone support is provided by actual human beings.

Is there any extra charge for the support you provide?

No, it's included.

Can I get continuing education hours for this EA Exam Preparation Course?

The IRS allows us to grant up to six hours of CE for this course. However, the primary goal of this course is not to get CE credits. The point is to pass the EA Exam.

How many hours will it take me to complete the course?

Remember, this is not a traditional CE course where you need to "knock out" XYZ hours for your credits. This is a test preparation course. How long you spend on the lessons will depend on your own situation. We recommend allotting 20-40 hours of study time per part of the EA Exam.

How many hours of video are in the course?

Glad you asked! We have over 40 hours of video instruction in this course--more BY FAR than any other course provider. You get video instruction on literally every topic that could appear on the EA Exam. We do recommend that you take an "on demand" approach and watch the videos that are most pertinent to your individualized needs as far as which areas to study. That being said, if you want to use this course as your "360 Degree Complete" education on every aspect of the U.S. tax system, be our guest! :) Eva has dropped a ridiculous amount of knowledge for you in these videos. Note that videos are only available with the Total Package version. If you purchased Fast Pass and now realize you want the videos, you can upgrade within 90 days of purchase and get full credit for your Fast Pass investment towards the Total Package price.

What's the best way to use this course to pass the EA Exam?

Students are finding great success by following this simple, step by step system: First, get logged in and complete your initial Pre-Test assessment. This assessment will tell you which weakness areas you need to "shore up." Next, use the Adaptive Drills ("mini-tests") which will prove you're starting to shore up your weaker knowledge areas; answers for every question are provided, creating an interactive learning experience. If you've invested in the Total Package, "mix in" watching the video explanations for each topic, based on the Adaptive Drill readings that show you which topics you need to understand better. Once you've shored up those weaker areas, start working the Simulated Exams, which look and feel exactly like the EA Exam. Once your scores on the Simulated Exams indicate you're ready to pass the EA Exam, go take the test, and pass it. This is not a complicated process.

What is on the EA Exam?

The IRS publishes a list of topics that appear on the EA Exam. Our EA Exam Preparation Course precisely follows the IRS list of topics. There are three parts of the EA Exam: Individual Taxation, Business Taxation, and IRS Representation, Practices, and Procedures. As long as you know the topic areas on which IRS tests, you can pass the test.

Where do I take the Exam?

You will go to a testing center in your local area to take the test. Currently the testing centers are operated by a third party company, Prometric, Inc.

Do I need to take continuing education to maintain my EA license?

EAs must complete 72 hours of continuing education every three years, including at least two hours per year of ethics. This averages out to 24 hours of CE per year.

Do you have a money back guarantee on this product?

Yes. If you are not satisfied for any reason, simply let us know within 14 days of your purchase, and you'll receive a full refund. We're only happy if you're happy.

Will I keep my same Preparer Tax Identification Number (PTIN) once I become an EA?

Yes.

Do I need to have a PTIN before I take this course?

No.

Can Tax Problem Resolution work help me earn money when it's not tax season?

Yes, this type of work is available year-round.

Is it difficult to pass the EA Exam?

It is a challenging exam, yes, which is why it's so important that you properly prepare. On a scale of 1 to 10 we would say it is about a 7 in terms of difficulty. Taking an EA Exam Preparation Course makes it much easier to pass, and much more likely that you will pass on the first try.

Are you making earnings claims or guaranteeing me an earnings increase?

Absolutely not. As with any business, your results may vary and will be based on your individual capacity, business experience, expertise, and level of desire. There are no guarantees concerning the level of success you may experience. There is no guarantee that you will make any income at all and you accept the risk that the earnings and income statements differ by individual. Each individual’s success depends on his or her background, dedication, desire and motivation. The use of our information, products and services should be based on your own due diligence and you agree that the Company is not liable for any success or failure of your business that is directly or indirectly related to the purchase and use of our information, products, and services reviewed or advertised on this Website. That being said, we will do everything we can to help you achieve success. As long as you're willing to do your part, it's 100% doable.

What makes this course stand out from other courses?

Three main things differentiate this course from all others: 1) More video training than any other EA Exam Prep Course, by far, with over 45 hours video instruction. 2) The instructor, EA Eva Rosenberg, is an awesome teacher who is not incredibly boring and explains things in a very accessible way. 3) The customer support is outstanding, everyone involved in this Program actually cares about helping you become an EA!

Do I need any educational prerequisites before taking the EA Exam?

No.

Can I become an EA if I never went to college?

Yes.

What's the #1 thing I can do to make sure I pass the EA Exam?

Use an EA Exam Preparation Course with a diagnostic testing platform (such as our system), because diagnostic testing will show you the areas of tax knowledge you need to work on before you go take the Exam. Most tax pros are stronger in some areas and weaker in others. Our Adaptive Drills diagnostic testing system shows you which areas of tax law you need to study to assure yourself of a passing score.

How does the EA Exam compare to the CPA Exam?

Passing the EA Exam is much easier than passing the CPA Exam and for this reason many people who do not pass the CPA Exam choose to pass the EA Exam instead. Getting your EA credential allows you to do much (not all) of the same work as a CPA and, in many cases, earn as much or more than a CPA.

Is this course updated for the Tax Cuts and Jobs Act, a.k.a. "Tax Reform"?

Yes, and keep in mind the EA Exam is always one year behind. The IRS will update the EA Exam again starting in 2020 and this course will be updated in February of 2020 to reflect the new materials. The current course is the most updated material that you will see on the real EA Exam.

Why are you calling this the "EA Exam," when the IRS calls it something different?

The IRS uses the term "Select Enrollment Examination" (SEE) to describe the test you need to pass to become an Enrolled Agent. For ease of understanding, we are using the term "EA Exam" on this page. So many acronyms, so little time... :)

Can I take the parts of the Exam separately?

Yes, you can take each part separately, if you choose.

How many questions are on the EA Exam?

100 questions per part and there are three parts.

How much does it cost to sit for the EA Exam?

It costs $181.94 per part to sit for the EA Exam. There are 3 parts. This fee is charged by Prometric, Inc., the test administrator.

Do I need to take any additional actions to become an EA, other than pass the test?

In addition to passing all three parts of the Select Enrollment Examination (SEE), you will need to fill out IRS Form 23 (brief application), and also undergo a background check. We provide you with full instructions about the process as part of this training course. You also must renew your Preparer Tax Identification Number (PTIN) every year in order to keep your EA license active.

Can Pronto Tax School, Inc. provide me with my EA continuing education?

Yes, we can. Visit courses.prontotaxschool.com to see our EA CE options.

Does Pronto Tax School, Inc. offer a payment plan for this product?

We do offer payment plan solutions in some cases. For more info, please email support AT prontotaxschool.com or call us 310-422-1283. Be advised that the price when you pay via payments, your price will be higher due to the risk and expense we may incur in collecting payments. We advise full payment up front as that is the option where we see people enjoying the best success in passing the exam. Once you go "all in," you show to yourself that you're serious about passing the Exam.

What can I do if I have additional questions before purchasing this program?

We are always happy to answer any questions you may have! Please feel free to contact us by email support AT prontotaxschool.com or phone 310-422-1283 or Facebook.com/prontotaxschool and send us a Facebook message. You can also review the list of Frequently Asked Questions about the EA Exam located at this page on the IRS website.

Your Satisfaction is Guaranteed with Our Rock Solid 14-Day Money Back Guarantee

You are fully protected by our 100% Satisfaction Guarantee. If you don't see the value of our program within the first 14 days, just let us know and we'll send you a full, prompt refund. We're only happy if you're happy!

We look forward to helping you pass the EA Exam on the first try. We measure our success exclusively by the success we help YOU achieve.

Let's roll!

Copyright 2018-2020. All Rights Reserved. Pronto Tax School, Inc.