Built by Independent Tax Pros, for Independent Tax Pros.

Dare to Compare!

We Love It When You Compare Our Offer to Other Offers, We Want to Compete to Earn Your Business!

Pronto Tax Systems Software + Training + Support Package Includes:

-

1040 tax software with all forms included

-

Desktop or Online Version, your choice!

-

Personalized, 1-on-1 installation support

-

Help converting from prior tax software

-

Help importing past year client data

-

Top-rated tech support team, CLUTCH reps!

-

All states included at no extra cost

-

Mobile Phone App with your company name and logo at no extra cost

-

Access to past year tax software programs all the way back to 2004 at no extra cost

-

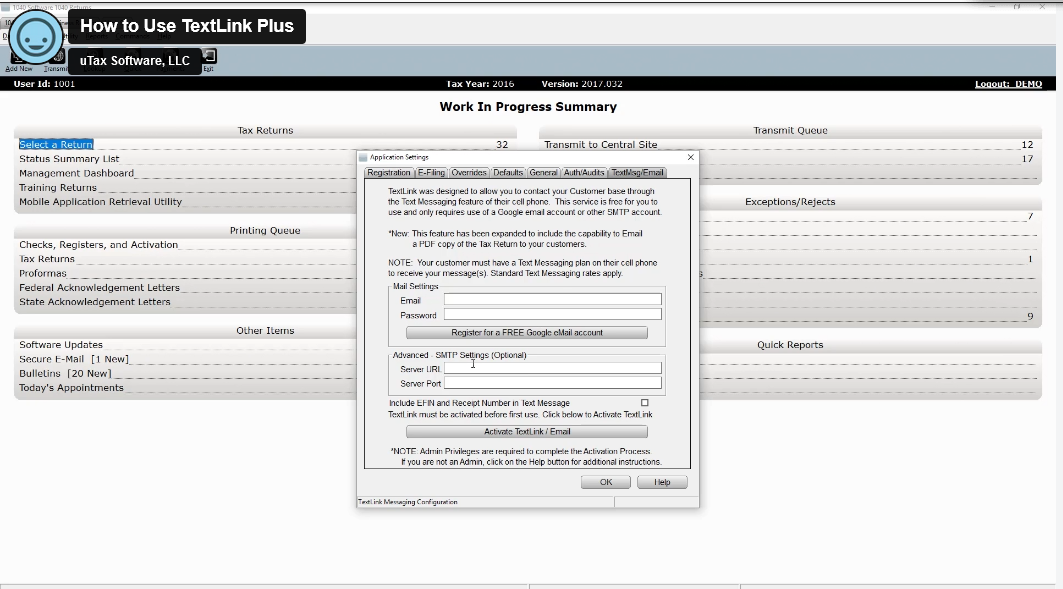

Outbound Text Message marketing tools built into the software at no extra cost

-

Access to past year tax software programs all the way back to 2005 at no extra cost

-

Add users at no extra cost (as long as all returns e-filed from same location)

-

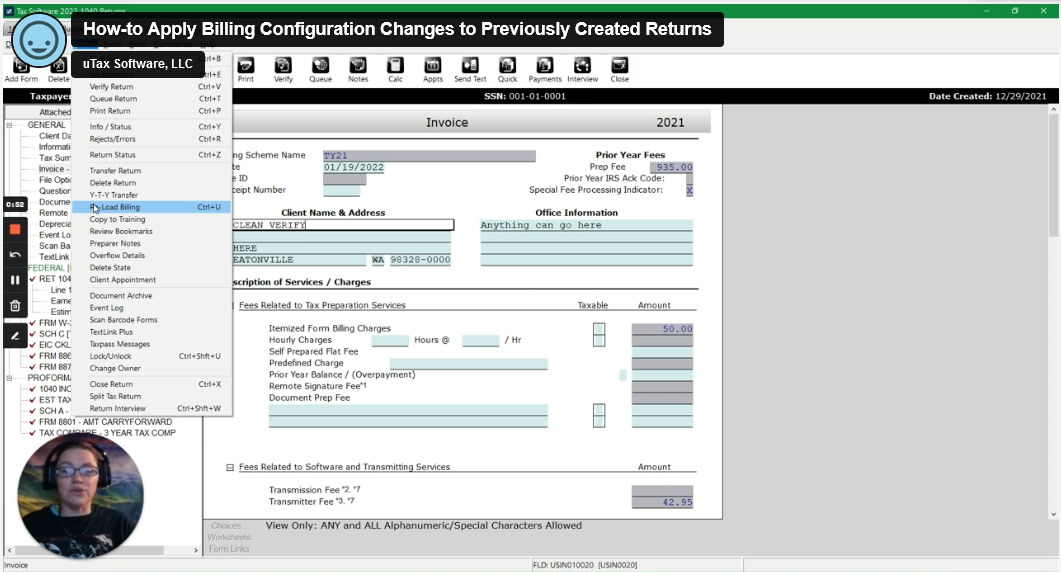

Suggested per form prices built into the software ("plug and play" or customize)

-

Software training sessions walking you through using the software, including practice tax returns

-

"Plug and play" email marketing sequence to attract new clients (32 "ready to go" emails, plus full step-by-step training on how to set up your FREE email marketing system)

-

"Plug and play" Tax Marketing Power Pack created by our professional graphic designer, including flyer, business card, retractable banner sign, and referral coupon. All materials in both English and Spanish! (NOTE: we provide the designs, you pay for your own materials, printing, or other production costs.)

-

"Low Cost, Effective Facebook Advertising for Tax Professionals" training

-

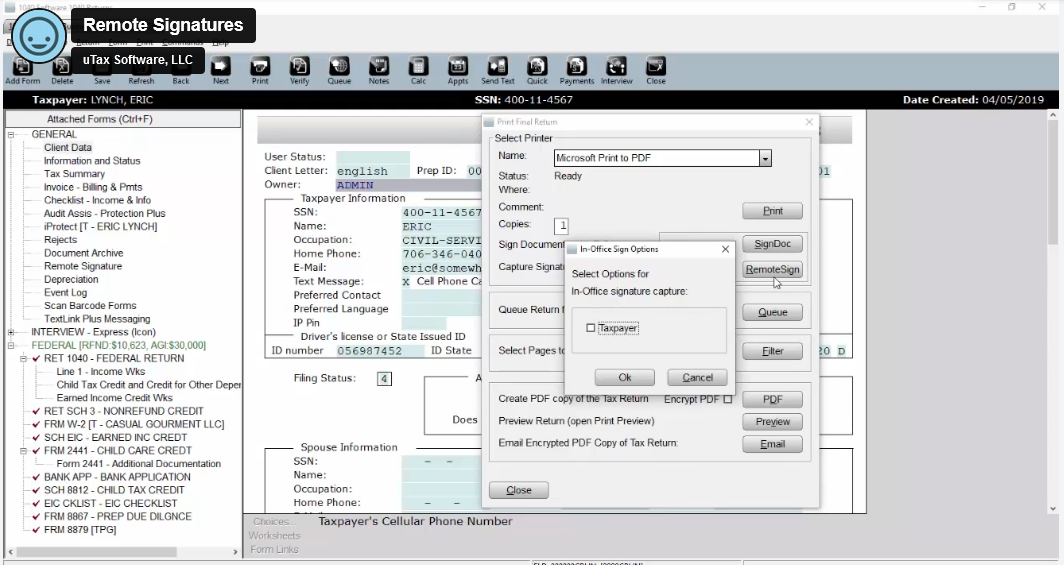

Help setting up bank products and training on how to use bank products to increase your tax earnings

-

Step-by-step training video showing you EXACTLY how to set up pro-level email marketing for your clients

-

No need to update your software (Online version)

-

Works on Mac and PC (Online version)

-

Use it on a desktop, laptop, and tablet (Online version)

-

Allows you to prepare returns anywhere with real-time tax return query (Online version)